Hi guys,

i need your support…

We have two distinct segments based on jobs-to-be done. Put simply: one has low willingness and ability to pay and the other one has high willingness and abilitly.

Same goes for regional differences: central europe high, eastern low etc.

However, i was not able yet to convince my boss that we should have different list prices for segments and regions. His main argument: if we reduce list price, we will reduce actual price since sales will start negotiation at a lower point (which they already do anyway) and we will miss out on the occasional high price customer from the low price segment / region (which we do get sometimes). Bonus: this will increase complexity in systems, guidelines etc

Did you face similar obstacles?

Happy to hear your thoughts

Context:

- prettty early in our pricing journey, low maturity

- legacy of 25+ years of selling to whoever at whatever price, do everything to win the customer

- Our product landscape is simple, packaging is not yet implemented

- basically no official price communication

- b2b saas

- 55.000 customers

- 95% telesales

2 Likes

Hey Patrick,

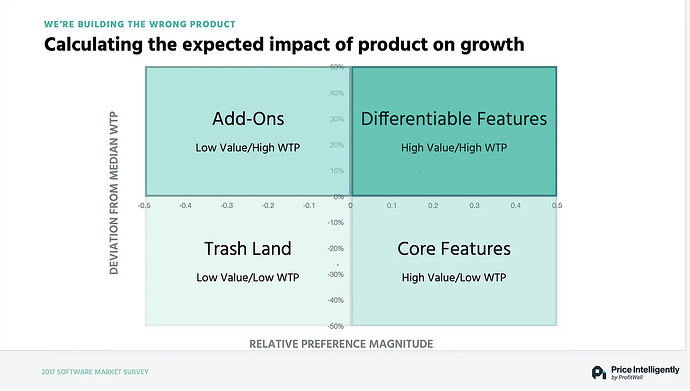

I think one of the best ways to build a case for your boss is to collect some data on these customer cohorts (if you haven’t already). When I was consulting at ProfitWell, we called this quantifying your buyer personas. Basically, you map feature preference/JTBD and willingness to pay to the different customers you serve.

Great article on it here.

If you’re planning to lower the entry price, I’d look at active users actual usage, and seek out opportunities to either gate features or limit usage metrics to ensure you don’t cannibalize too much revenue from the existing plan.

4 Likes

Patrick,

One good way is to bring in the voice of the customer. Do some customer interviews and test willingness to pay for the different segments. It is easy for the boss to disagree with you, but less easy to disagree with customer data.

Another way to make the case is to analyze discount levels by customer segments. I’d expect the customers with higher wtp would have less discounts.

However you’ll need a product packaging strategy that would justify the higher/lower price points. The last thing you want to do is alienate your higher paying customers who are getting the most value from your product.

5 Likes

Thanks for your suggestions

Fortunately, the product has two very distinct use cases (=JTBD) and provides lower value for the low-willingness-to-pay-segment, so we wouldn’t create problems on that front.

Will do 2 things: prove again that low segments / regions are far off from global list price, leading to nothing but huge discounts.

And second show that varying price points need to be supported by value differentiation, i.e. packaging

thanks again

2 Likes

Hey Patrick!

Firstly, I do support price discrimination and I do think that there is no single, perfect price, even within the same segment. In my experience, I always think about ranges and not a single price point.

Having said that, I would break this problem into two.

Strategic:

- What is the company strategy and how it permeate to the product you’re selling?Gain share, revenue increase, margin?

- What are your manager’s goals and incentives? This is important to discover why is he apprehensive, what’s his risk tolerance and how can you negotiate next steps with him.

Tactical

Although it is not a one-way door decision, I would want to lower the risk by:

1. Getting data to back up your facts. Ask product and product marketing to give more depth on the two segment you’ve identified, and not just price data. Some examples of what I would do with the data: are these two segments the same or different across verticals, regions, or any other criteria? What’s the money you are leaving on the table? Model different scenarios of the impact of changing prices on current customers.

2. Getting key stakeholders buy-in from product and sales, if you have them. Have them onboard. Be careful not to corner your manager and creating an everyone-against-him kind of situation.

3. Start small. You can lower the risk (your manager’s and yours) by testing your initiative in the next sales cycle for new customers or with existing customers by adjusting their prices. Or pick a region, or a whatever makes sense to press-test your assumptions. You get what I mean… Given the low-stakes approach, you will have a greater chance of buy-in.

Before deciding on the course of action, I can see at least two scenarios after confirming there are two distinct segments with different price acceptance/WTP:

- You get the approval to move forward.

- You don’t get approval and do nothing, but start focusing on highest paying customers (probably your manager’s call)

- Yo don’t get an approval, but maybe you want to formalize the discounting that’s already happening.

Document as much as possible and if you are going for 1, be transparent to everyone (especially sales) in the company how a customer qualifies for each bucket in terms of package and price.

All the best Patrick!

2 Likes

I think you might get more traction if you talked in terms of packaging and segmentation first and backed into the pricing conversation. I would start with a value model (I would say that, I am getting predictable) and how how value is different for different segments and if value is different it follows that packaging and pricing need to be different.

2 Likes

Thanks Steven, this seems to be the way.

I used a similar approach a couple of days ago when we discussed introducing a premium service package for larger customers. Traditionally, our company would bundle it with the flat rate and attempt to negotiate higher prices with prospects.

I argued that premium service offers significant value to some customers (let’s monetize!) while being completely irrelevant to others (shouldn’t be a standard feature!). An added bonus is that if we start negotiations with the higher anchor price—including the premium service package—we should be able to achieve a higher transaction price, even if customers opt for the lower tier. Consequently, even if the sales mix for the new tier turns out to be 0%, we should still be able to reduce discounts on the standard package.

Now, I need to identify more features that can drive differentiation for our segments.

3 Likes

This matrix was a helpful framework for us at ProfitWell @Patrick. In your case, Premium Service seems like a perfect fit for an Add On (low relative preference, high willingness to pay among those that value it)

3 Likes

![]()